Trading memecoins is exhilarating and filled with opportunities—but also it comes with risks. To stay ahead, you need the right tools that will help you make informed decisions, act quickly, and avoid pitfalls. Below are the top 10 platforms that every memecoin trader must have, along with why they’re the best tools and their pros and cons.

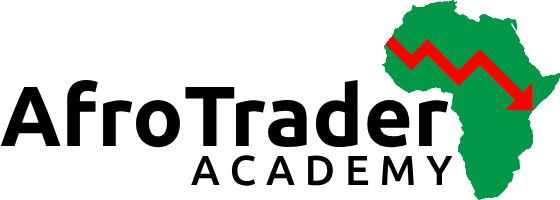

01. Dexscreener

A powerful charting and analytics platform for decentralized exchanges. Dexscreener helps you monitor real-time prices, identify trading volumes, and track market movements across multiple blockchains.

- Why you should use Dexscreener:

Its ability to provide real-time data and multi-chain support ensures you’re always in the loop with the latest market movements. - Pros:

- Comprehensive charting tools.

- Tracks across various blockchains (e.g., Ethereum, BSC, Solana).

- Free to use with no subscription required.

- Cons:

- Limited predictive analytics.

- Not beginner-friendly for those unfamiliar with charting tools.

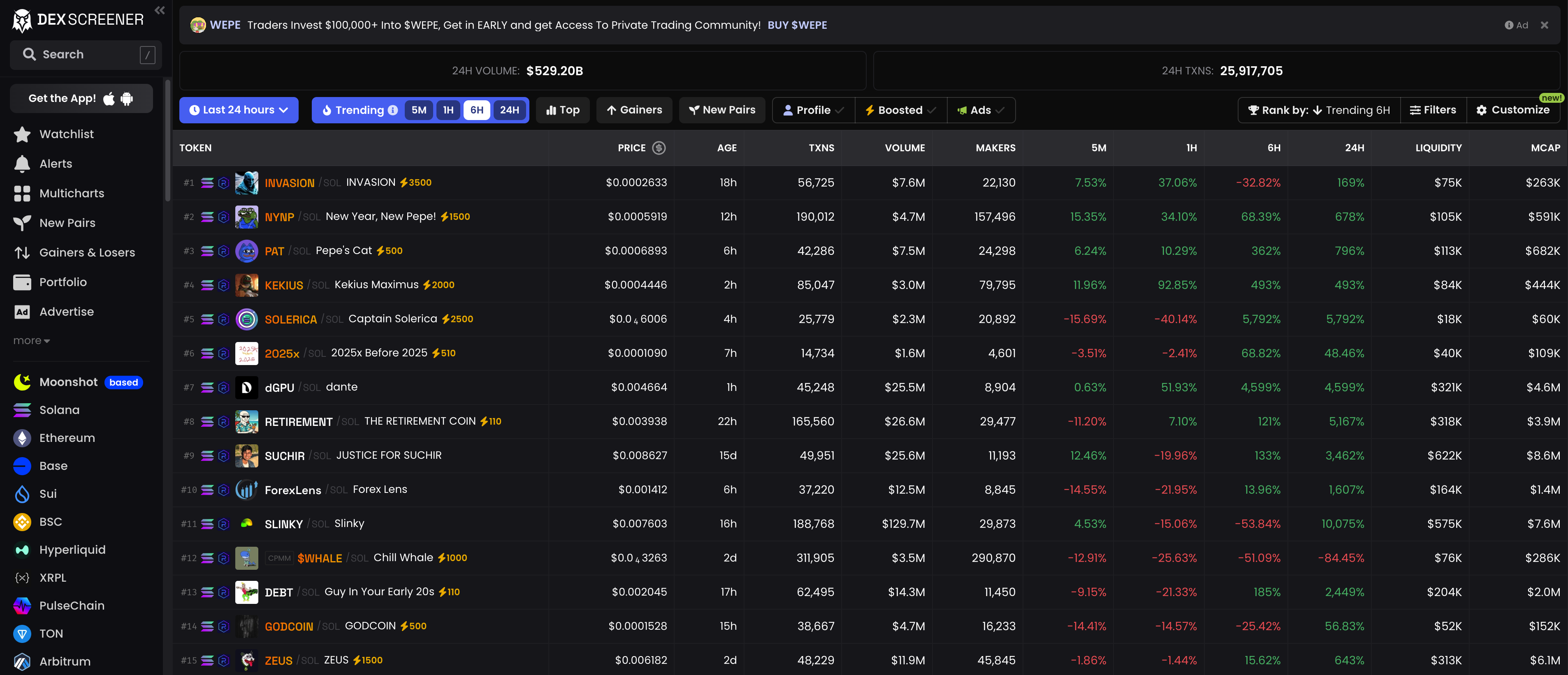

02. Phantom Wallet

The phantom wallet is the go-to wallet for managing Solana-based memecoins. Its user-friendly interface and advanced security features make it perfect for storing, sending, and swapping assets.

- Why you should use phantom wallet:

Its simplicity and robust security features make it perfect for Solana enthusiasts. - Pros:

- User-friendly interface.

- Supports staking Solana tokens.

- Integrated DApp browser for quick access to Solana-based platforms.

- Cons:

- Limited to Solana; no support for Ethereum or BSC tokens.

- Dependent on the Solana network’s stability.

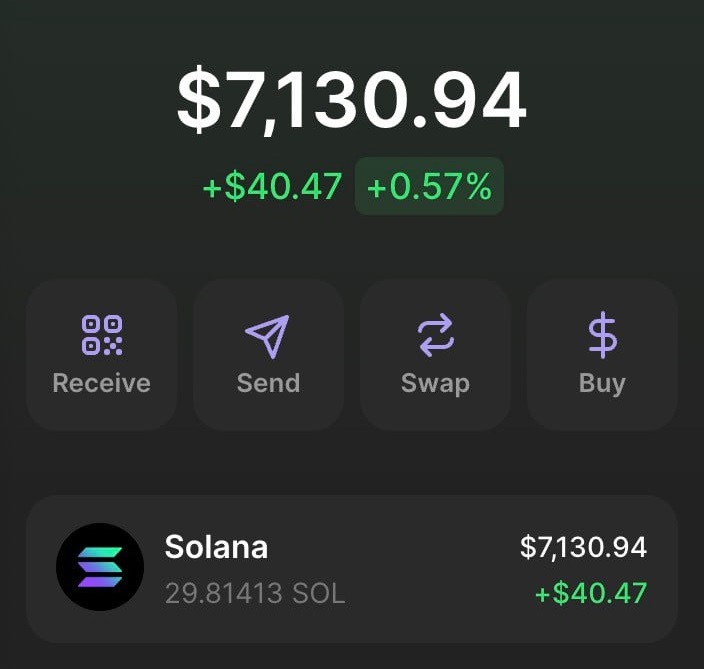

03. GMGN.ai

An AI-driven platform that scans and identifies upcoming memecoin launches, GMGN.ai helps you catch potential gems early.

- Why you should use GMGN.ai:

Its AI capabilities give traders an edge by highlighting promising coins before they gain popularity. - Pros:

- Predictive analysis to find early opportunities.

- Saves time on researching new tokens.

- Cons:

- Requires a subscription for full features.

- Predictions aren’t always accurate; due diligence is still needed.

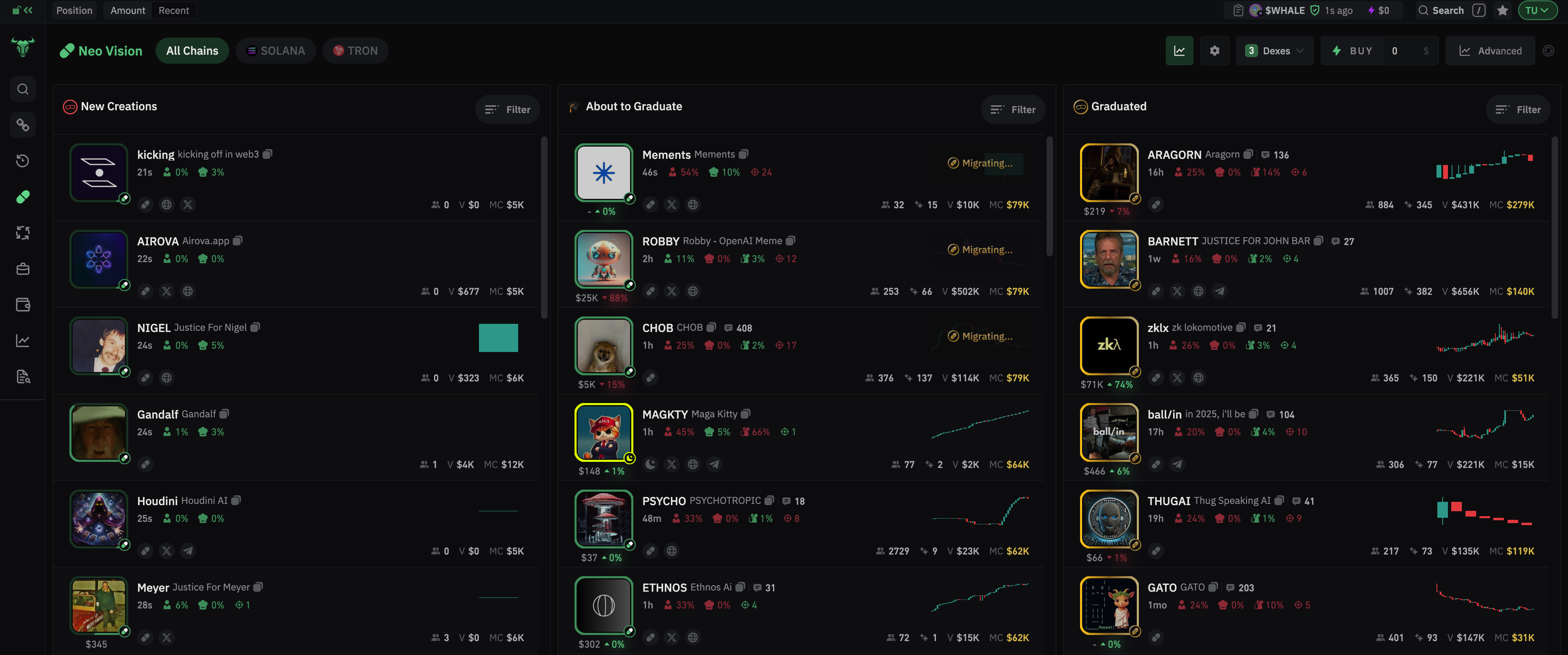

04. Neo.Bullx.io

A cutting-edge tool for tracking wallet activities and detecting smart money inflows. The Neo.Bullx.io platform was designed to monitor whale movements and big players’ investments. This helps you to stay informed about where the big players are investing.

- Why you should use Neo.Bullx.io:

By revealing where large amounts of money are flowing, you can mimic strategies of successful traders. - Pros:

- Helps identify whale wallets.

- Provides real-time updates on wallet transactions.

- Cons:

- Complex for beginners.

- Requires subscription for advanced tracking features.

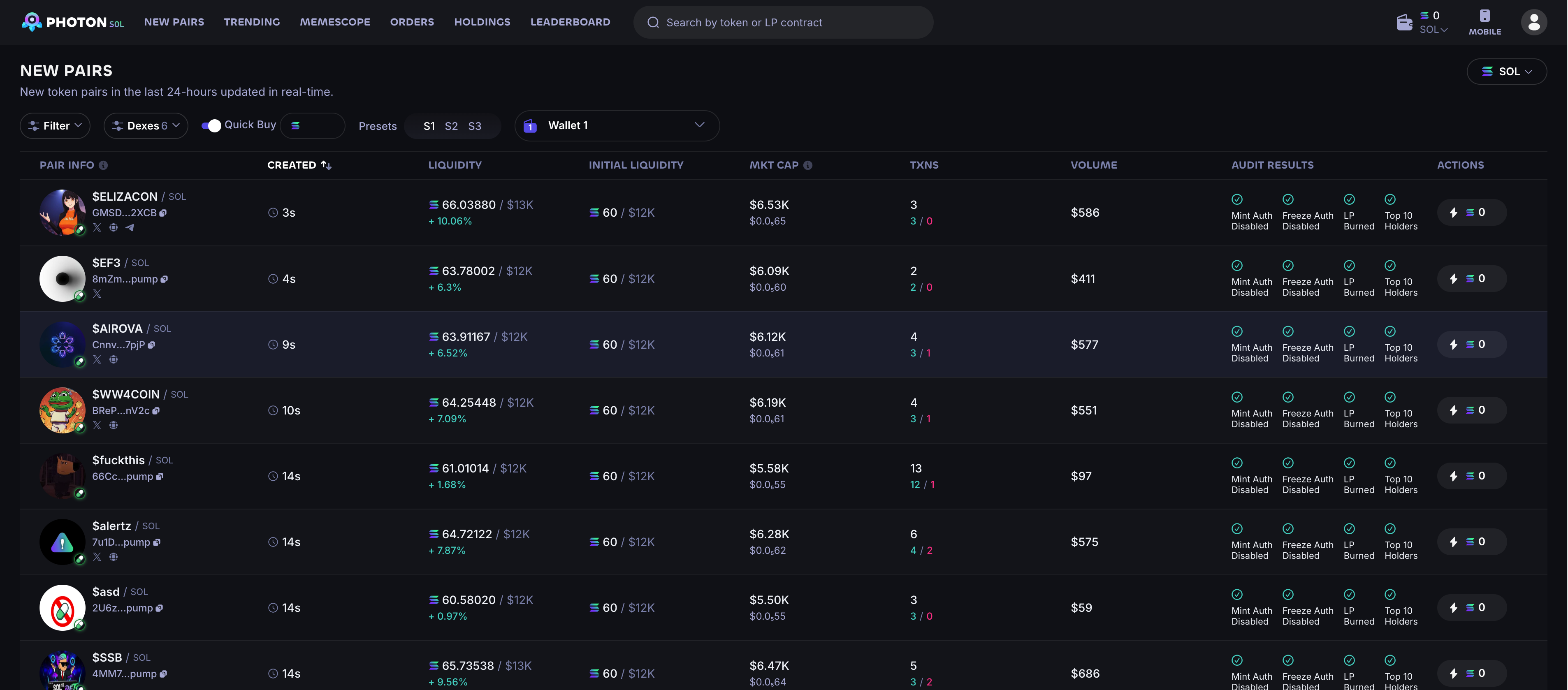

05. TradeWithPhoton

A high-speed sniper bot that enables lightning-fast trading, TradeWithPhoton helps you get ahead in competitive memecoin markets.

- Why you should use Photon:

Speed is everything in memecoin trading, and this bot ensures you’re first in line. - Pros:

- Extremely fast execution times.

- Automation reduces manual trading errors.

- Cons:

- Requires technical expertise to set up.

- High risk if poorly configured or misused.

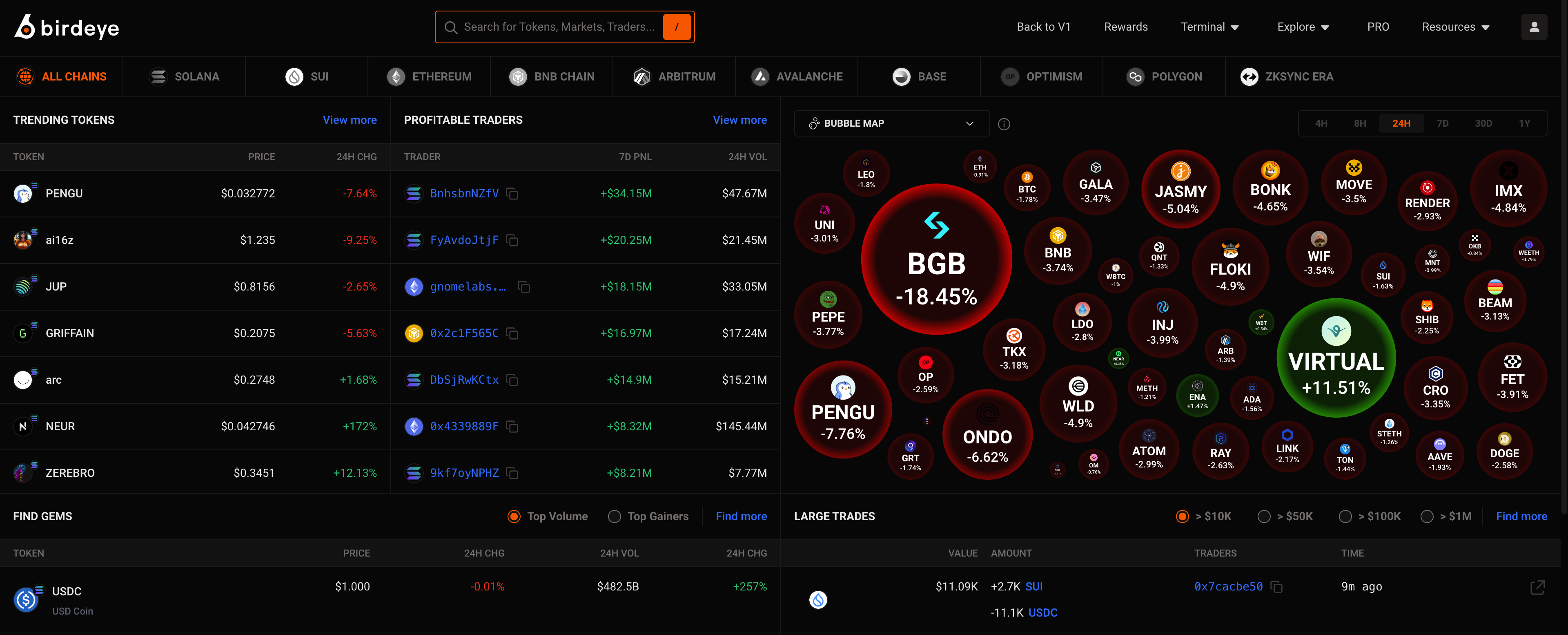

06. Birdeye

Focused on Solana, Birdeye aggregates token data, providing insights into liquidity, transactions, and token performance.

- Why you should use Birdeye:

Its Solana-specific insights help traders make data-driven decisions. - Pros:

- Detailed token analytics for Solana.

- Tracks liquidity and price changes in real time.

- Cons:

- Limited to Solana tokens.

- Data is less extensive compared to multi-chain platforms.

07. Rugcheck

Avoid scams and rug pulls with Rugcheck, a platform that scans smart contracts and assesses their legitimacy.

- Why you should use Rugcheck:

Memecoins often come with risks, and Rugcheck helps you avoid costly mistakes by verifying token safety. - Pros:

- Scans for vulnerabilities in token contracts.

- Provides clear pass/fail results for quick assessments.

- Cons:

- False positives or negatives can occur.

- Focuses only on contract analysis, not market behavior.

08. Holderscan

Analyze token holder data to assess community strength and token stability. Holderscan shows you how tokens are distributed among holders.

- Why you should use Holderscan:

Knowing the distribution of tokens helps you gauge the likelihood of price manipulation. - Pros:

- Reveals whale holdings and token distribution.

- Helps identify overly centralized tokens.

- Cons:

- Doesn’t provide real-time price data.

- Limited to on-chain analysis.

09. Dexcheck.ai

With AI-powered tools, Dexcheck.ai helps traders monitor liquidity, social sentiment, and memecoin performance.

- Why you should use Dexcheck.ai:

Combining financial and social metrics ensures you’re well-informed about market trends and hype. - Pros:

- Tracks social and financial data.

- User-friendly interface with AI insights.

- Cons:

- Subscription-based for full access.

- Social sentiment may not always correlate with price movements.

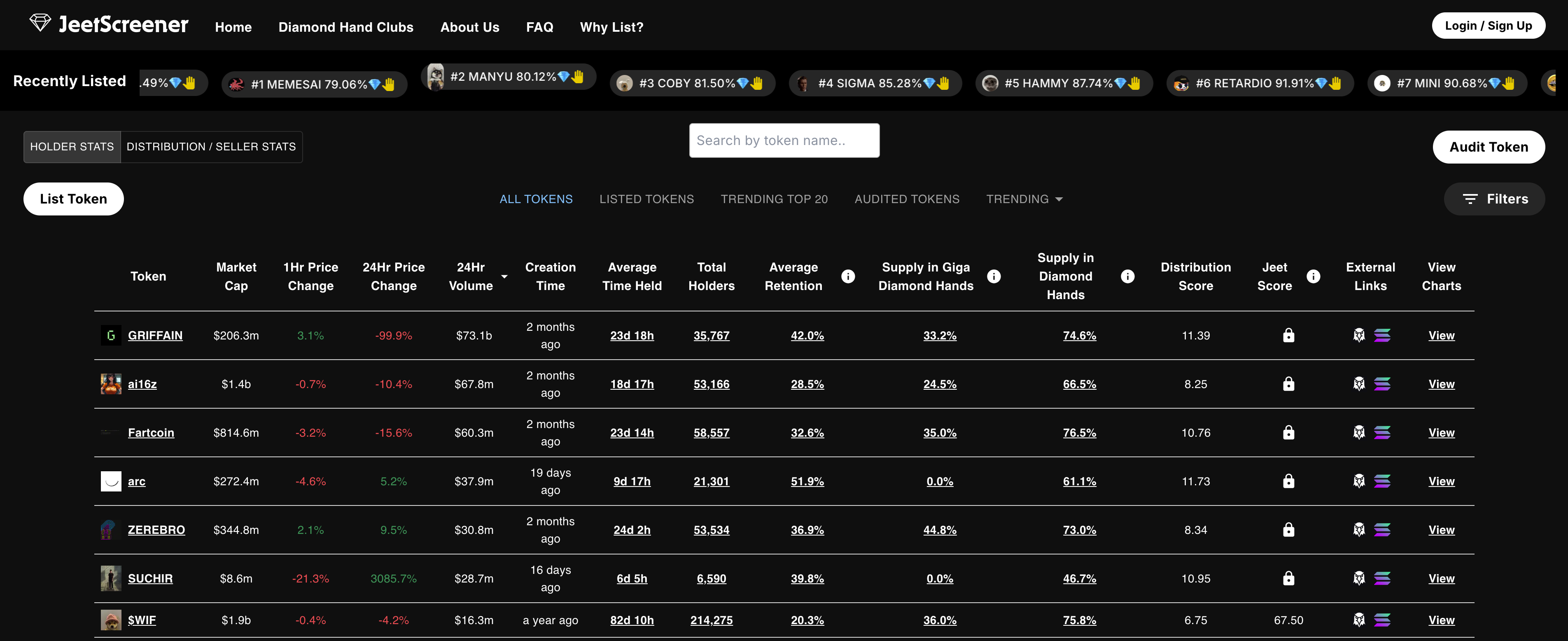

10. Jeetscreener

Jeetscreener keeps you informed about large sell-offs and whale activities, helping you anticipate price changes.

- Why you should use Jeetscreener:

Understanding whale activities can help you make strategic decisions and avoid getting caught in sell-offs. - Pros:

- Monitors large transactions in real time.

- Alerts for unusual sell patterns.

- Cons:

- Focused on sell-offs; limited buy-side tracking.

- Data interpretation requires experience.

Conclusion:

These platforms cover all critical aspects of memecoin trading, from analysis and wallet tracking to fast execution and scam prevention. By incorporating these tools into your trading routine, you can increase your chances of success while minimizing risks. Choose the ones that best suit your trading style and goals—and always trade responsibly!