In today’s fast-paced trading environment, having the right tools and resources at your disposal can make all the difference between success and failure, especially for beginners. Whether you’re venturing into stocks, forex, or cryptocurrencies, using the right platforms can streamline your trading journey, helping you make informed decisions and manage risks more effectively. From advanced charting tools to real-time data analysis, these websites are essential for traders looking to build a solid foundation. In this post, we’ll dive into some of the most crucial websites every trader—especially beginners—should know about, highlighting their features, pros, and cons. These websites provide a combination of technical analysis, market insights, data aggregation, and learning opportunities that are vital for any beginner trader looking to succeed across various markets.

1. TradingView

TradingView is one of the most popular platforms for charting and technical analysis. It allows users to create and analyze charts with various tools, indicators, and drawing functions. For beginners, it offers a user-friendly interface and a community where they can share ideas, follow other traders, and see market sentiment. Its versatility in handling multiple markets like forex, stocks, and crypto makes it a valuable tool.

Pros:

Easy-to-use interface for beginners.

Wide range of technical indicators and charting tools.

Access to multiple asset classes (forex, crypto, stocks).

Social trading community for idea sharing.

Cons:

Premium features can be expensive.

Real-time data for some markets may require paid subscription.

Not ideal for executing trades (works best as an analysis tool).

2. ForexFactory

ForexFactory is a major hub for forex traders, providing an economic calendar, market news, and a community forum. Beginners will find the economic calendar especially useful as it highlights key global financial events and economic reports, which can significantly impact the forex markets. The community forum also allows them to learn from more experienced traders and engage in discussions about strategies, market trends, and trading psychology.

Pros:

Highly detailed economic calendar.

Active forum with discussions on forex strategies.

Real-time market news and updates.

Cons:

Mostly focused on forex (limited for stocks and crypto).

The forum may contain unverified trading advice.

Interface can be a bit dated compared to modern platforms.

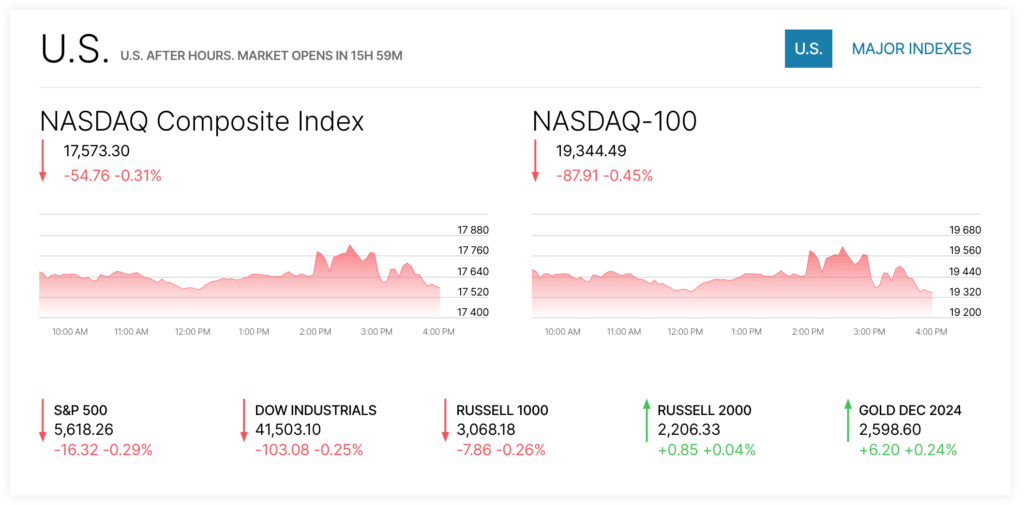

3. Nasdaq

The Nasdaq website is critical for stock traders as it provides real-time data on stock markets, economic reports, and breaking financial news. Beginners will find it helpful for understanding market trends, getting updates on listed companies, and following major indices. Additionally, Nasdaq’s financial insights help traders stay informed about global economic conditions, earnings reports, and IPOs, which are important for developing a well-rounded trading strategy.

Pros:

Provides real-time stock market data.

Access to financial news, IPO updates, and earnings reports.

Insight into major market indices and companies.

Cons:

Primarily focused on stocks (limited for forex and crypto traders).

Some advanced data may require a premium subscription.

Beginners may find the layout dense.

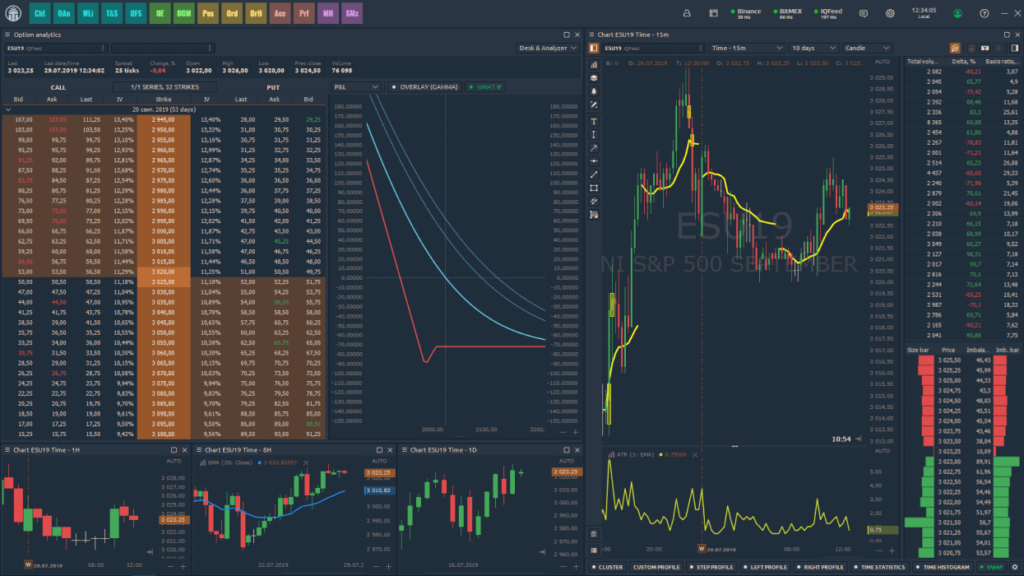

4. Quantower

Quantower is a multi-asset trading platform that provides advanced trading features and market analysis tools. It is especially valuable for traders looking to integrate multiple brokers and exchanges. Beginners benefit from its intuitive interface and ability to connect to a wide range of data providers, offering real-time access to different asset classes like forex, futures, and crypto. Its customizable trading experience also helps new traders to set up their workspace according to their needs.

Pros:

Supports multiple brokers and exchanges.

Advanced trading tools (order flow, DOM).

Highly customizable interface.

Real-time market data across multiple assets.

Cons:

Can be overwhelming for beginners due to advanced features.

Paid features may be necessary for full access.

Steeper learning curve compared to simpler platforms.

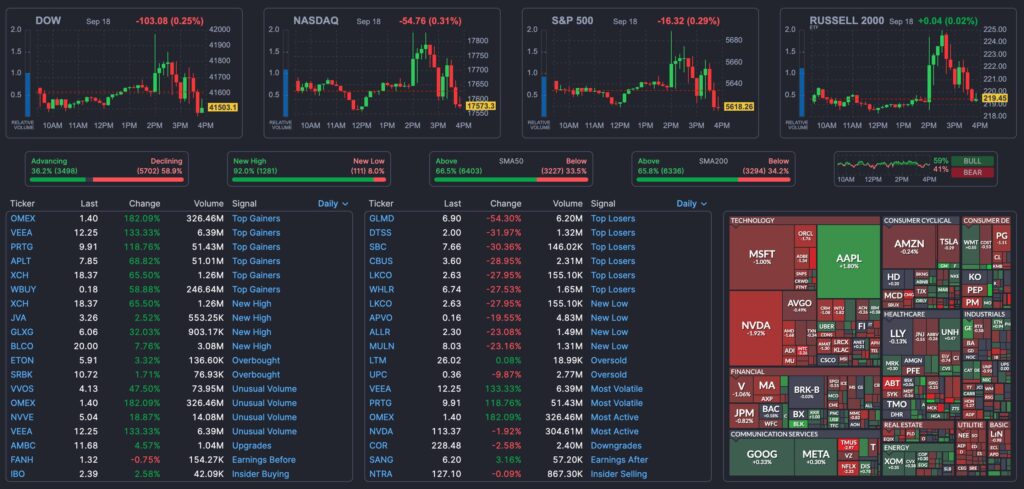

5. Finviz

Finviz is a stock screener and analysis tool. For beginners, it’s a fantastic resource for filtering stocks based on various criteria such as volume, price, and technical indicators. It helps traders identify potential trades by providing market visualizations like heat maps, news, and stock comparisons. Finviz is particularly beneficial in understanding market breadth and narrowing down stock choices, making it a great tool for new traders to grasp market dynamics.

Pros:

Intuitive stock screener with multiple filters.

Visual tools like heatmaps for market insights.

Access to news and insider trading data.

Cons:

Focuses mainly on U.S. stocks (not ideal for international markets).

Free version comes with ads and delayed data.

Limited tools for crypto or forex traders.

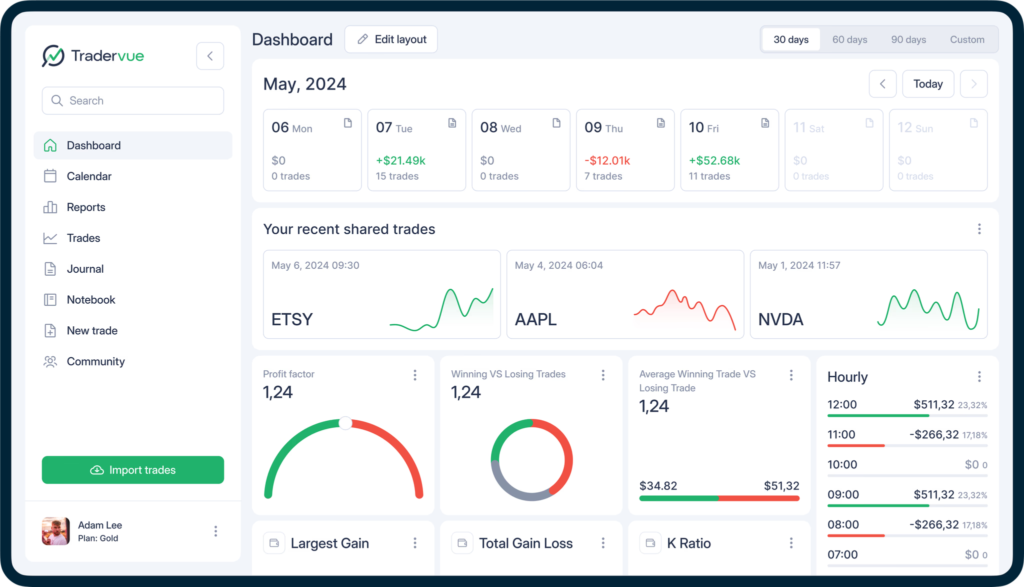

6. TraderVue

TraderVue is a journaling and trade analytics platform. It allows traders to track, analyze, and review their trades. For beginners, maintaining a trading journal is vital to learning from mistakes and improving strategies over time. TraderVue makes it easy to log trades, analyze performance, and identify patterns in both successful and unsuccessful trades, leading to better trading discipline and strategy refinement.

Pros:

Great for tracking and analyzing trade performance.

Helps identify mistakes and improve strategy.

Supports multiple asset classes (stocks, forex, options, futures).

Cons:

Free version has limited features.

Advanced reporting tools require a paid subscription.

Interface might be less intuitive for complete beginners.

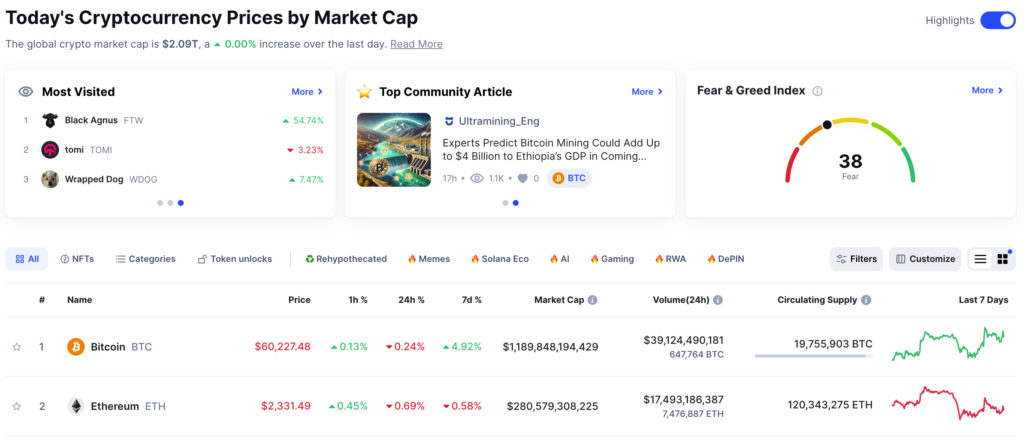

7. CoinMarketCap

CoinMarketCap is the go-to platform for crypto traders looking for real-time data on cryptocurrency prices, market capitalization, trading volume, and rankings. Beginners in crypto benefit from its detailed metrics on thousands of coins and tokens. The site provides access to market trends, historical data, and recent developments in the crypto space, helping traders make informed decisions.

Pros:

Provides comprehensive data on thousands of cryptocurrencies.

Real-time price tracking and market cap data.

Easy-to-navigate platform for beginners.

Cons:

Limited in-depth analysis or research tools.

Focuses purely on crypto (not helpful for other asset classes).

Some ads and third-party promotions may clutter the interface.

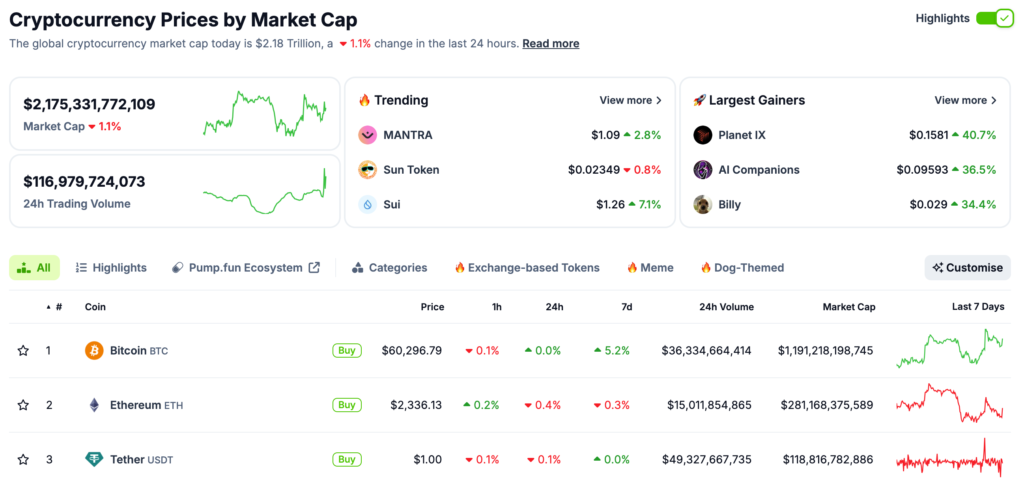

8. CoinGecko

Just like CoinMarketCap above, CoinGecko is another essential resource for crypto traders. It provides detailed analysis on cryptocurrencies, including price, volume, market capitalization, and even developer activity and community growth. For beginners, CoinGecko is a comprehensive platform to monitor the entire cryptocurrency market and compare different tokens, making it easier to spot potential investments.

Pros:

Offers detailed analysis, including developer activity and liquidity.

Provides real-time crypto market data and rankings.

Community features and additional insights like social media metrics.

Cons:

Primarily focused on crypto (not ideal for forex or stock traders).

Premium features require a subscription.

Can be overwhelming for absolute beginners.

9. Messari

Messari offers in-depth research, analysis, and metrics for cryptocurrency markets. For beginners, it’s particularly useful as it provides detailed reports, research insights, and project fundamentals that can help them make data-driven decisions. The platform also aggregates market data, news, and performance indicators, which are critical for evaluating long-term investments in the crypto space.

Pros:

Provides in-depth research and reports on cryptocurrency markets.

Access to detailed market metrics and insights.

Offers both free and premium research resources.

Cons:

Primarily focused on crypto markets.

Advanced analysis might be too complex for beginners.

Some reports are behind a paywall.

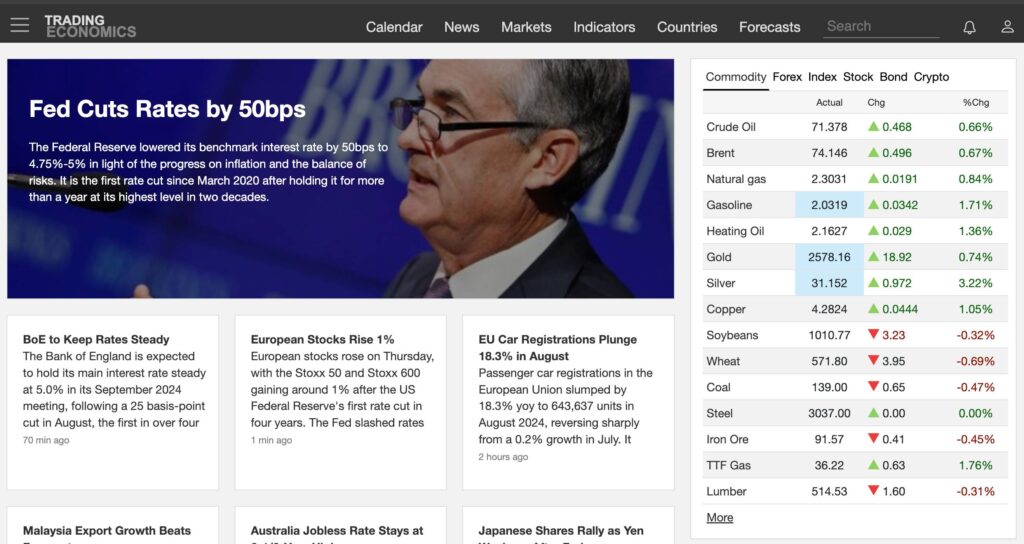

10. TradingEconomics

TradingEconomics provides comprehensive economic data and forecasts. It covers major macroeconomic indicators like GDP, inflation, interest rates, and employment figures across different countries. For beginners, understanding the broader economic context behind market movements is crucial, and TradingEconomics helps them stay informed about these macroeconomic events that can influence forex, stocks, and commodities.

Pros:

Offers detailed macroeconomic data for many countries.

Great for understanding the global economic context.

Real-time updates on economic events and indicators.

Cons:

Limited tools for real-time trading or technical analysis.

Some data may require a premium subscription.

Interface is primarily data-focused, lacking visual appeal.

Bonus Sites:

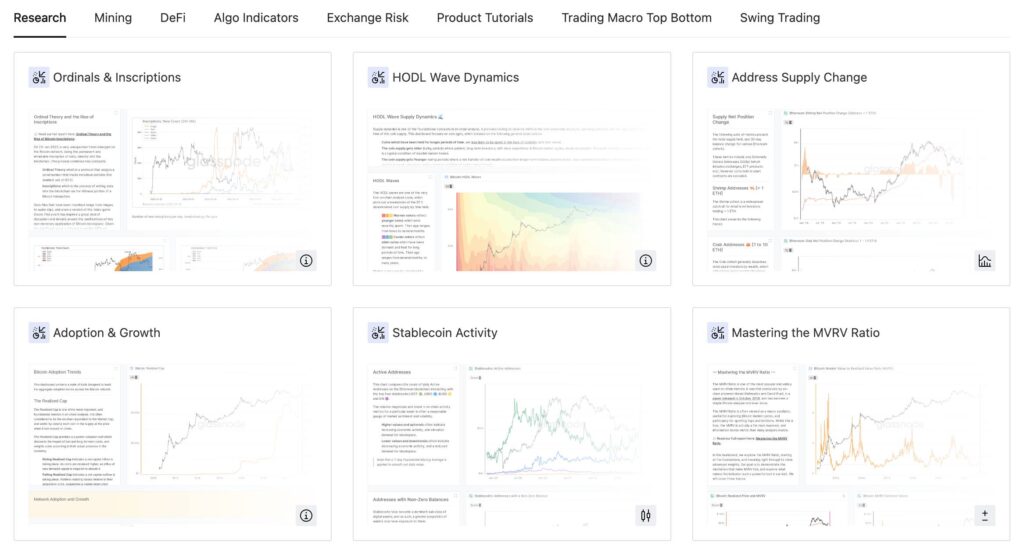

11. Glassnode Studio

Glassnode is a blockchain data and intelligence platform. It provides on-chain data and metrics for cryptocurrency traders. For beginners, this site is crucial because it offers insights into market sentiment, liquidity, and network health, all of which can impact cryptocurrency price movements. By analyzing on-chain data, new traders can gain a better understanding of underlying market forces that drive the price of digital assets.

Pros:

Excellent source for on-chain data and blockchain analytics.

Provides insights into liquidity and market sentiment.

Useful for tracking the health of the blockchain network.

Cons:

Primarily focused on cryptocurrency data.

Advanced metrics may be difficult for beginners to interpret.

Premium features can be expensive.